The demand for housing in the US continues to outpace supply. In fact, according to Zillow, housing inventory won't reach pre-pandemic levels again until 2024 at the earliest. That means bidding wars will likely remain the name of the game, and prices will continue to rise. Over the past two years, year-over-year home values have risen a total of 32%—between January 2021 and January 2022 alone, annual growth accelerated by 19.2%. Interestingly, that’s well above the peak annual rate of 14.5% posted in the lead-up to the 2008 housing bubble, which raises a critical question: are we in the middle of a housing bubble?

What is a Housing Bubble?

A housing bubble is a specific type of asset price bubble (also called an economic bubble) in which prices are much higher than underlying fundamentals can justify. Housing bubbles typically have a large effect on the overall economy because they are credit-fueled, affect regular homebuyers, and involve large financial assets (i.e., homes).

A housing bubble is characterized by two phases. First, housing prices increase dramatically driven by speculation and overly optimistic projections. Then, housing prices fall dramatically.

The 2008 Housing Bubble

Housing bubbles happen periodically in every housing market in the world, but one we can all remember is the 2008 Housing Bubble. This housing bubble was triggered by a combination of cheap debt, predatory lending practices, and financial engineering that resulted in many borrowers being placed into unaffordable mortgages. As early as 2005, there were signs of a growing bubble preparing to burst. From 2005-2008, foreclosures increased, bankruptcies increased, sales fell, and inventory rose—all indicators of credit stress.

When the situation reached its peak and the bubble burst, it provoked a foreclosure crisis among homeowners and a credit crisis among investors who owned bonds backed by defaulted mortgages. In the subsequent economic downturn, millions of Americans lost their jobs, as well, and the median household income dropped from $54,489 in 2007 to $52,195 in 2009.

Is History Repeating Itself in 2022?

Several trends in the current housing market have helped incite the current explosion in housing prices:

- Historically low interest rates (similar to the low interest rates we saw in the early 2000s)

- Pandemic-related U.S. fiscal stimulus programs

- COVID-19-related supply-chain disruptions that have exacerbated the imbalance between supply and demand

In light of these trends, the Federal Reserve Bank of Dallas recently released a report titled "Real-time market monitoring finds signs of brewing U.S. housing bubble”. In the report, they say, “Our evidence points to abnormal U.S. housing market behavior for the first time since the boom of the early 2000s.” The price-to-rent ratio and the price-to-income ratio show indications that 2021 house prices appear increasingly out of step with fundamentals, which as we know, is a key characteristic of a housing bubble.

However, there is no expectation at this time that a housing crisis like we saw from 2007-2009 is on the horizon. There are a few notable differences between the housing market then and now.

- Excessive borrowing doesn’t appear to be fueling this housing market boom like it did in the early 2000s. In 2007, 7% of disposable personal income was going towards mortgage debt service payments. Today, that figure is around 3.8%.

- As a result of the 2008 housing crisis, market participants, banks, policymakers, and regulators are much more prepared to assess the significance of a housing boom in real-time and take action early.

- Lending standards are much more stringent now than they were in the early 2000s, ensuring higher quality homebuyers.

Odds are good that we aren’t in a housing bubble on the brink of bursting, but that doesn’t mean that the real estate market is necessarily healthy. Inventory is still incredibly low, and buyers are being priced out of the market every day. Whether you’re a realtor, a broker, an investor, a developer, or anyone else with a vested interest in real property, you need all the help you can get.

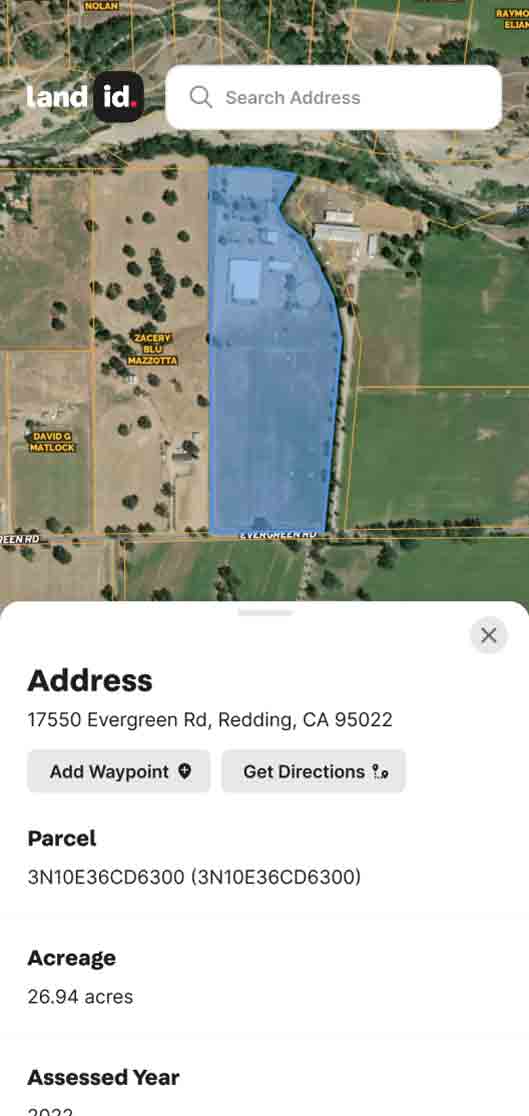

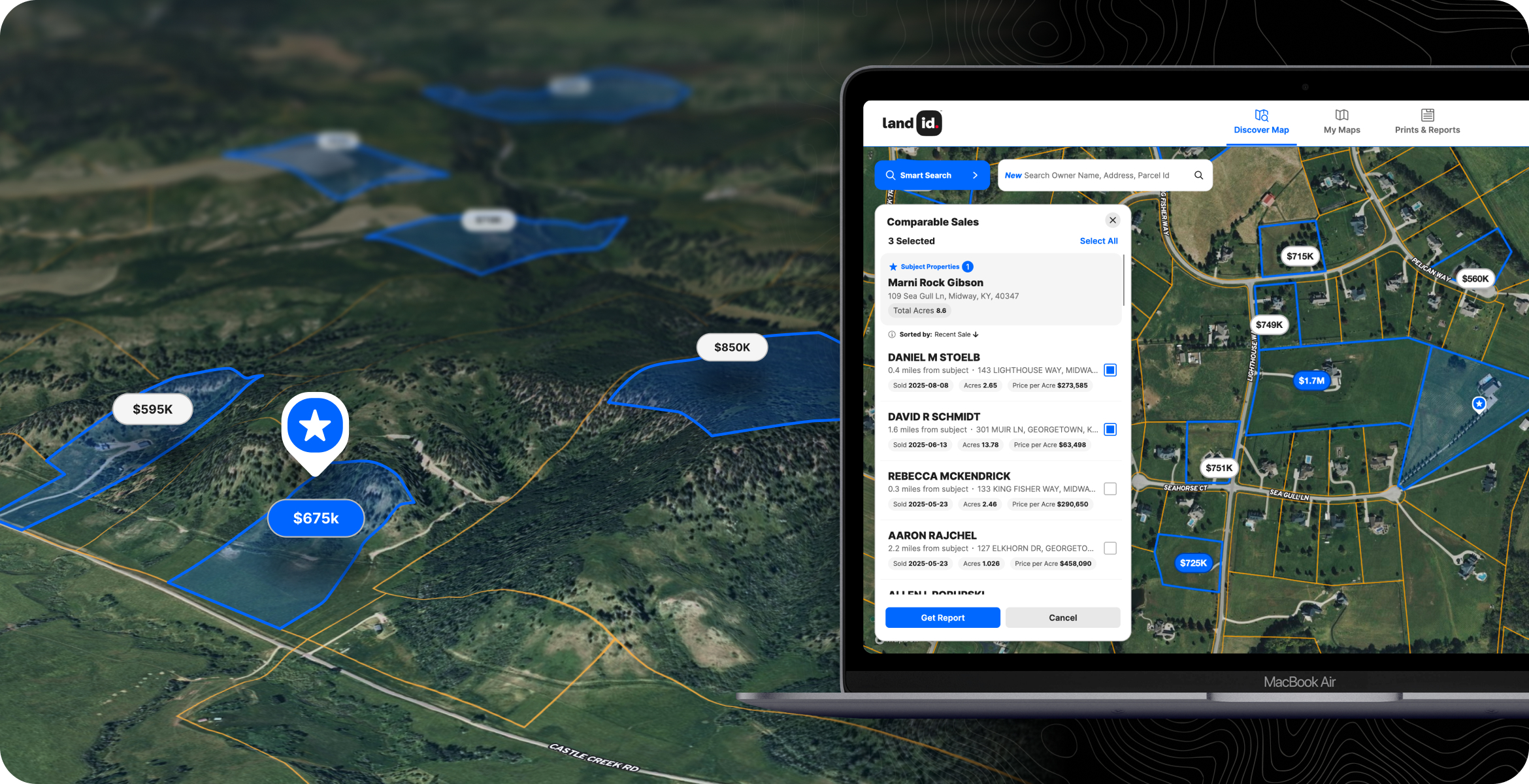

Thousands of real estate professionals have already used Land id® (formerly MapRight) to scope out properties, share information about the land, and visualize key data points in a brand new way. To start building your own maps, sign up for our 7-day free trial today!

FAQs

Continue Reading