An outcome of the 2017 Tax Cuts and Jobs Act, the Qualified Opportunity Zone Program is designed to incentivize investors to invest in low income and undercapitalized communities, areas normally not considered. The goal is to spur economic growth and job creation while providing tax benefits to investors who participate in the program. Even though the program is new, properties located within Opportunity Zones have already seen some appreciation in value and marketability.

In this way, Opportunity Zones create opportunities for both investors and distressed communities who could benefit from the economic stimulation investment funds can generate. But how exactly do these tax incentives work, and what can this program do for landowners?

Qualifying for Opportunity

Specifically, the program works like this:

Low income communities and certain neighboring areas, defined by population census tracts, can qualify as Opportunity Zones. Governors nominated which areas in their states they want to designate, and these areas are officially certified by the US Department of the Treasury. Across all fifty states, the District of Columbia and five US territories, thousands of low income communities are designated as Opportunity Zones. Individuals and corporations can invest in these zones through a Qualified Opportunity Fund.

If investors place their capital gains into a Qualified Opportunity Fund, they will be able to defer paying taxes on these gains until 2026 or until the asset is sold. The longer capital gains remain in the fund, the more an investor’s basis in the original investment increases over time. If an investment stays in a qualified opportunity fund for at least a decade, investors will pay no taxes on any capital gains produced through their investment. All because they invested in an Opportunity Zone.

Opportunity funds are intended to finance a range of projects focused on encouraging business creation, job creation, infrastructure development and more.

Seizing Opportunity in Rural Areas

Many agricultural areas have been designated as Opportunity Zones, so many landowners likely own land that qualifies for these tax incentives. There may be potential for some of your land to be sold into qualified opportunity funds for higher uses. The program can also provide a way for you to reinvest capital gains received in the sale of timber and other resources from your property or the sale of tracts of land you hold in a more tax effective way. If you own an agriculture-based business, you can invest and expand your business in a way that supports your current forestry or agriculture operations, too.

If you’re purchasing land through a qualified opportunity fund, you can benefit from the incentives with even minor modifications or expansions to property; things such as adding a warehouse for food storage, a food packaging or sorting facility or a farm stand to sell produce. Or, you could lease property and create a forest product business that utilizes the land’s resources. There may even be opportunity here to invest in logging or trucking businesses, something forestry is desperately in need of in many regions.

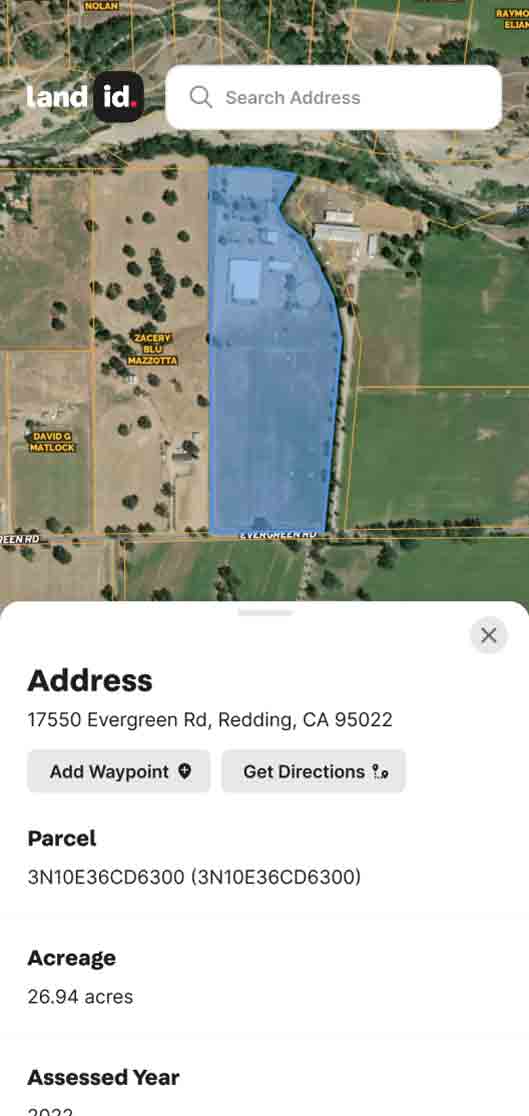

A variety of real estate development projects and businesses also have the potential to benefit from Opportunity Zones in more ways than we have time to get into here. Needless to say, if you invest or own land, you need to do your homework on the Qualified Opportunity Zone Program. Luckily for Land id® (formerly MapRight) users, Opportunity Zones are already included as one of our GIS layers, so as you plan your real estate activities, you’ll always have this information on hand.

Start making maps in minutes by signing up for our 7-day free trial!

FAQs

Continue Reading